ARTICLE

ABSTRACT

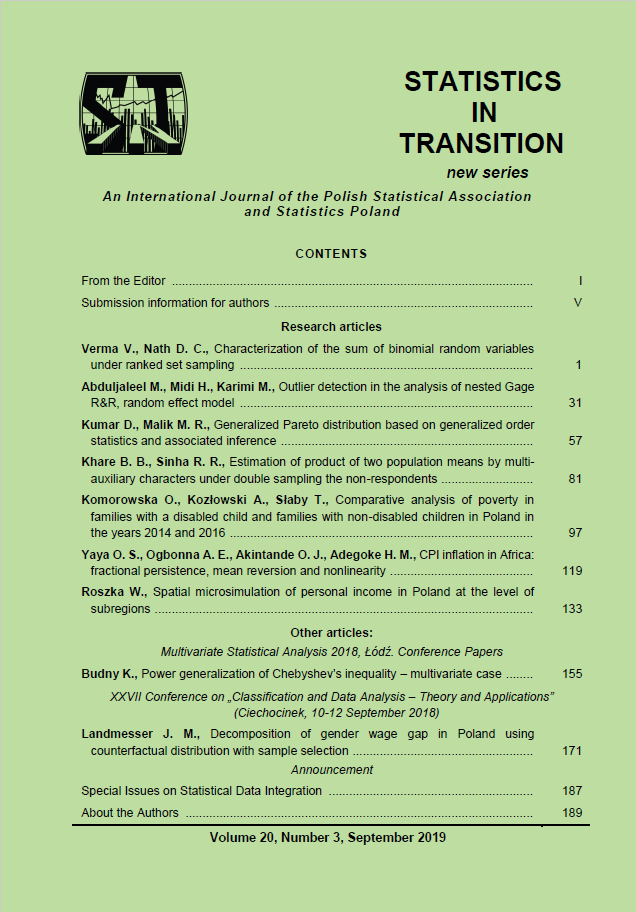

Price stability has been one of the key mandates that apex monetary authorities strive to achieve globally. While most developed economies have achieved single digit inflation rates, most developing economies, especially African countries still experience alarming double-digit inflation rates. This paper therefore examined the dynamics of inflation in sixteen African countries. We employed the fractional persistence framework with linear trend and non-linear specifications based on Chebyshev’s polynomial in time. The results indicated nonlinear time trend in inflation for most of the countries. With the exception of Burkina Faso, which exhibited plausibility of naturally reverting to its mean level, the majority of the selected African countries would require stronger interventions to revert their observed inflationary levels to their mean levels.

KEYWORDS

Africa, Fractional Integration, Inflation Rate, Mean Reversion, Nonlinear Trend, Structural Break

JEL

22

REFERENCES

ADENEKAN, A. T., NWANNA, G. A., (2004). Inflation Dynamics in a Developing Economy: An Error Correction Approach. African Review of Money Finance and Banking, pp. 77–99.

ADU, G. MARBUAH, (2011). Determinants of Inflation in Ghana: An Empirical, Investigation. South African Journal of Economics, 79 (3), pp. 251–269.

AJIDE, K. B, LAWANSON, O., (2012). Inflation Threshold and Economic Growth: Evidence from Nigeria. Asian Economic and Financial Review, 2 (7), pp. 876– 901.

ALI, H., (2011). Inflation Dynamics: The Case of Egypt. MPRA Paper No. 36331. Available at: http://mpra.ub.uni-muenchen.de/36331/.

BAWA, S., ABDULLAHI, I. S., IBRAHIM, A., (2016). Analysis of Inflation Dynamics in Nigeria (1981 – 2015). CBN Journal of Applied Statistics, 7, pp. 255–276.

BEN NASR, A., AJMI, A. N., GUPTA, R., (2014). Modelling the volatility of the Dow Jones Islamic market world index using a fractionally integrated time varying GARCH (FITVGARCH) model. Applied Financial Economics, 24, pp. 993–1004.

BIERENS, H. J., (1997). Testing the unit root with drift hypothesis against nonlinear trend stationarity with an application to the US price level and interest rate. Journal of Econometrics, 81, pp. 29–64.

BOATENG, A., LESOANA, M., SIWEYA, H., BELETE, A., GIL-ALANA, L. A., (2017). Modelling persistence in the conditional mean of inflation using the ARFIMA process with GARCH and GJRGARCH innovations: the case of Ghana and South Africa. African Review of Economics and Finance, 9 (2), pp. 96–130.

BURGER, P., MARINKOV, M., (2005). The South African Phillips Curve: A triangular puzzle? Paper presented at the “Development Perspectives – Is Africa Different?” Biennial conference of the Economic Society of South Africa (ESSA), Durban, South Africa.

BURGER, R., DU PLESSIS, S., (2006). A New Keynesian Phillips Curve for South Africa. SARB Conference 2006.

CAPORALE, G. M., CARCEL, H., GIL-ALANA, L. A., (2015). Modelling African inflation rates: nonlinear deterministic terms and long-range dependence. Applied Economics Letters, 22 (5), pp. 421–424.

CAPORALE, G. M., CARCEL, H., GIL-ALANA, L. A., (2017). Central bank policy rates: Are they cointegrated? International Economics, 152, pp. 116–123.

CECCHETTI, S., DEBELLE, G. (2006). Has the inflation process changed? Economic Policy, 21 (46), pp. 311–352.

CUESTAS, J. C., GIL-ALANA, L. A., (2016). A non-linear approach with long range dependence based on Chebyshev polynomials. Studies in Nonlinear Dynamics and Econometrics, 23, pp. 445–468.

DIEBOLD, F.X. AND INOUE, A., (2001). Long memory and regime switching. Journal of Econometrics, 105, pp. 131–159.

FABAYO, J. A., AJILORE, O. T., (2006). Inflation: How much is too much for Economic growth in Nigeria. Indian Economic Review, 41 (2), pp. 129–147.

FEDDERKE, J. W., SCHALING, E. (2005). Modelling Inflation in South Africa: A Multivariate Cointegration Analysis. South African Journal of Economics, 73, pp. 79–92.

FIELDING, D., K. LEE, SHIELD, K., (2004). The Characteristics of Macroeconomic Shocks in the CFA Franc Zone. Research Paper No. 2004/21, March, World Institute for Development.

GIL-ALANA, L. A., (2008). Fractional integration and structural breaks at unknown periods of time. Journal of Time Series Analysis, 29, pp. 163-185.

GIL-ALANA, L. A., CUNADO, J., GUPTA, R., (2015). Persistence, mean reversion and nonlinearities in infant mortality rates. Department of Economics, University of Pretoria Working paper series, No. 2015–74.

GIL-ALANA, L. A., SHITTU, O. I., YAYA, O. S., (2012). Long memory, Structural breaks and Mean shifts in the Inflation rates in Nigeria. African Journal of Business Management, 6 (3), pp. 888–897.

GIL-ALANA, L. A., YAYA, O. S., SOLADEMI, E. A., (2016). Testing unit roots, structural breaks and linearity in the inflation rates of the G7 countries with fractional dependence techniques. Applied Stochastic Models in Business and Industry, 32, pp. 711–724.

GRANGER, C. W. J., HYUNG, N., (2004). Occasional structural breaks and long memory with an application to the S&P 500 absolute stock returns. Journal of Empirical Finance, 11, pp. 399–421.

HODGE, D., (2002). Inflation versus unemployment in South Africa: is there a trade-off? South African Journal of Economics, 70 (3), pp. 417–443.

HODGE, D., (2006). Inflation and growth in South Africa. Cambridge Journal of Economics (30), pp. 163–180.

HODGE, D., (2009). Growth, Employment and Unemployment in South Africa. South African Journal of Economics, 70 (4), pp. 488–504.

HOSNY, A. S., (2014). What is the Central Bank of Egypt’s Implicit Inflation Target? International Journal of Applied Economics, 13 (1), pp. 43-56.

IMIMOLE, B., ENOMA, A., (2011). Exchange Rate Depreciation and Inflation in Nigeria (1986 – 2008). Business and Economics Journal, BEJ28, pp. 1–12.

KAPETANIOS, G., SHIN, Y., SNELL, A., (2003). Testing for a unit root in the nonlinear STAR framework. Journal of Econometrics, 112, pp. 359–379.

KAUSHIK, B., (2011). Understanding inflation and controlling it. Paper. Available at: http://finmin.nic.in/WorkingPaper/understanding_inflation_controlling.pdf

KIMANI, D. K., MUTUKU, C. M., (2013). Inflation Dynamics on the Overall Stock Market Performance: The Case of Nairobi Securities Exchange in Kenya. Economics and Finance Review, 2 (11), pp. 1–11.

KIRIMI, W. N., (2014). The Determinants of Inflation in Kenya (1970 – 2013). A research project presented to the School of Economics of the University of Nairobi, Kenya.

KWIATKOWSKI, D., PHILLIPS, P. C. B., SCHMIDT, P, SHIN, Y., (1992). Testing the Null Hypothesis of Stationarity against the Alternative of a Unit Root. Journal of Econometrics, 54, pp. 159–178.

MANKIW, N. G., (2001). The Inexorable and Mysterious tradeoff between Inflation and unemployment. The Economic Journal Conference Papers, 111 (471), C45–C61.

MIKKELSEN, J., PEIRIS, J. S., (2005). Uganda: Selected Issues and Statistical Appendix, IMF Country Report 05/172.

NELL, K. S., (2000). Is Low Inflation a Precondition for Faster Growth, The Case of South Africa, Department of Economics, University of Kent, United Kingdom.

NELL, K. S., (2006). Structural change and nonlinearities in a Phillips Curve model for South Africa. Contemporary Economic Policy, 24 (4), pp. 600–617.

ODUSANYA, I. A., ATANDA, A. A., (2010). Analysis of Inflation and its Determinants in Nigeria, MPRA Paper No. 35837.

OHANISSIAN, A., RUSSELL, J. R., TSAY, R. S., (2008). True or spurious long memory? A new test, Journal of Business Economics and Statistics, 26, pp. 161–175.

OSAMA, EL BAZ, (2014). The Determinants of Inflation in Egypt: An Empirical Study (1991-2012). The Egyptian Center for Economic Studies, MPRA Paper No. 56978. http://mpra.ub.uni-muenchen.de/56978/.

OULIARIS, S., PARK, J. Y., PHILLIPS, P. C. B., (1989). Testing for a unit root in the presence of a maintained trend. In Ray, B. (Ed.). Advances in Econometrics and Modelling. Kluwer, Dordrecht, pp. 6–28.

PAUL, H. W., NORMAN, E. D., ERNEST, I. H., (1973). Financial Accounting, New York: Harcourt Brace Javonovich, Inc. Page 429.

PALMA, W., (2007). Long memory time series: Theory and methods. John Wiley & Sons, New Jersey.

PHIRI, A., (2013). Inflation and Economic Growth in Zambia: A Threshold Autoregressive (TAR) Econometric Approach. Department of Economics and Management Sciences, School of Economics, North West University, Potchefstroom, South Africa, MPRA Paper No. 52093, http://mpra.ub.uni-muenchen.de/52093/.

ROBINSON, P. M., (1994). Efficient tests of nonstationary hypotheses. Journal of the American Statistical Associations, 89, pp. 1420–1437.

SALISU, A. A., OGBONNA, A. E., (2017). Improving the predictive ability of oil for inflation: An ADL-MIDAS Approach - Centre for Econometric and Allied Research, University of Ibadan Working Papers Series, CWPS 0025.

SVENSSON, L. E. O., (2003). Escaping from a Liquidity Trap and Deflation: The Foolproof Way and Others. Journal of Economic Perspectives, 17, pp. 145–166.

TABI, H. N., ONDOA, H. A., (2011). Inflation, Money and Economic Growth in Cameroon. International Journal of Financial Research, 2 (1), pp. 45–56.

VERMEULEN, C., (2015). Inflation, growth and employment in South Africa: Trends and trade-offs, ERSA working paper 547.

WOLDE-RUFAEL, Y., (2008). Budget Deficits, Money and Inflation: The Case of Ethiopia, The Journal of Developing Areas, 42 (1), pp. 183–199.